NYSE:TKO Analysis: Revolutionizing Entertainment with UFC and WWE Merger

A Deep Dive into TKO's Global Impact, Financial Strength, and Future Prospects | That's TradingNEWS

TKO Group Holdings: A Comprehensive Analysis of a Diverse Entertainment Powerhouse

Introduction: A Fusion of Giants in the Entertainment Arena

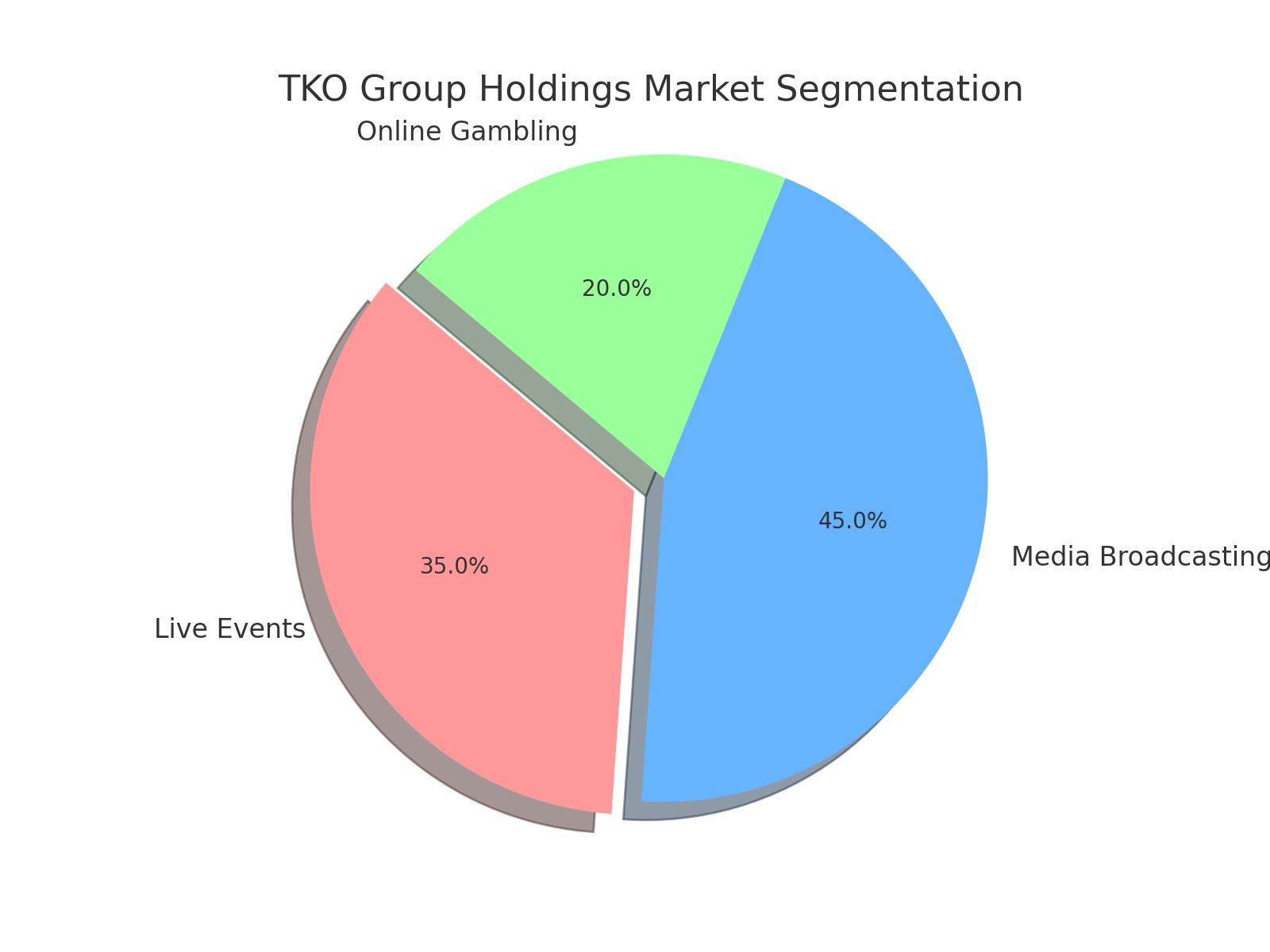

In a bold move that has reshaped the landscape of the entertainment industry, TKO Group Holdings (NYSE:TKO) emerges as a formidable conglomerate, blending the high-octane worlds of UFC and WWE. This strategic amalgamation has not only expanded TKO's footprint across various segments, including live events, media broadcasting, and online gambling but has also significantly enhanced its appeal to a global audience, setting a new benchmark for fan engagement and revenue generation.

Expanding Global Reach and Engaging Diverse Audiences

TKO's strategic prowess lies in its ability to cater to a global audience, broadcasting its electrifying events to over a billion households across nearly 170 countries. This expansive reach is a testament to the company's commitment to transcending cultural and geographical barriers, leveraging the international appeal of combat sports to foster a sense of global community and inclusivity among fans.

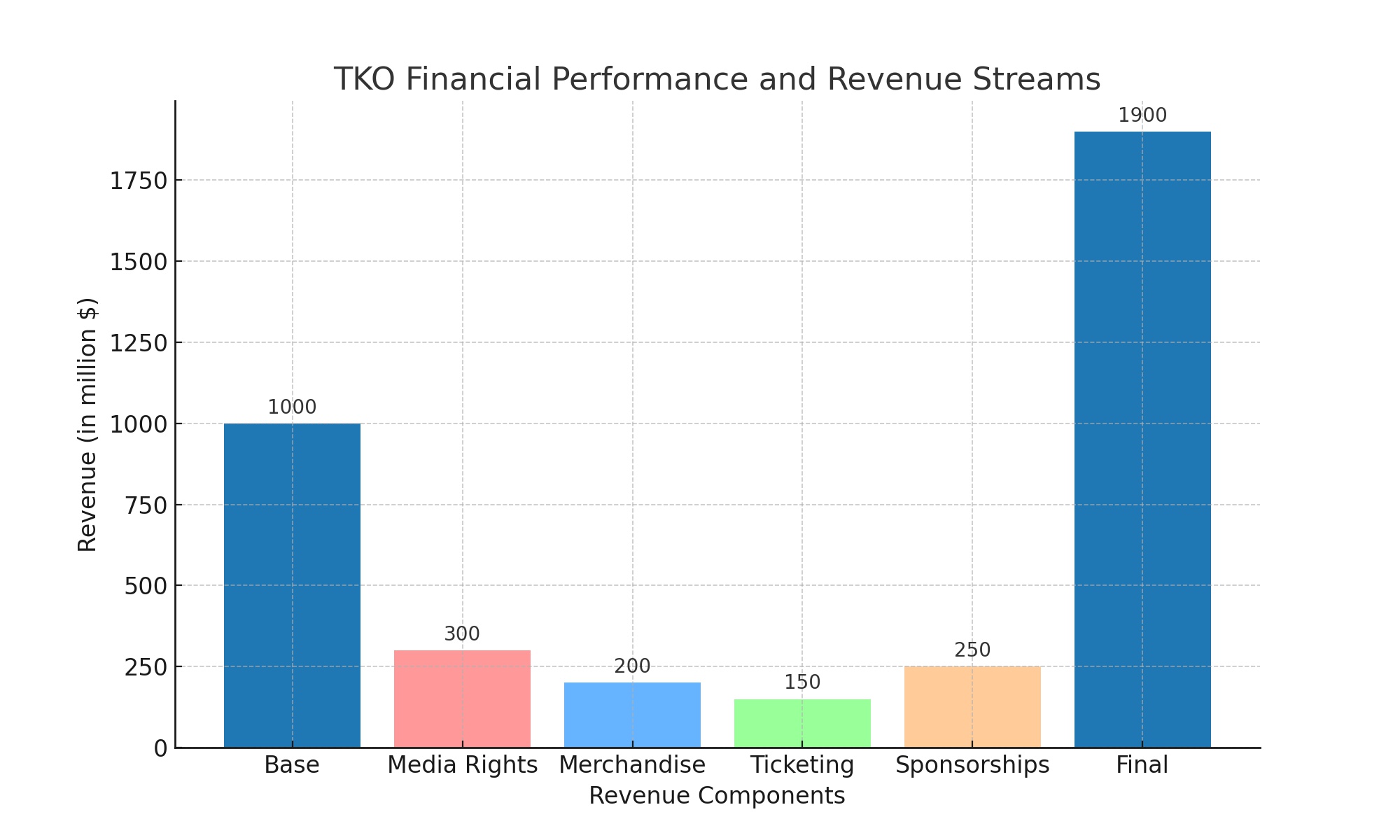

Robust Financial Performance and Revenue Diversification

At the core of TKO's success is a multifaceted revenue model that capitalizes on multiple streams, including media rights, merchandise sales, and ticketing for live events. The company's financial health is further bolstered by strategic partnerships and sponsorships, such as the notable agreement with Anheuser-Busch's Bud Light, underscoring the growing brand equity and financial resilience of TKO. With a market cap of $7.023B and a trailing P/E ratio of 19.49, TKO stands out for its solid financial foundation and growth potential.

Navigating Market Dynamics: Opportunities Amid Challenges

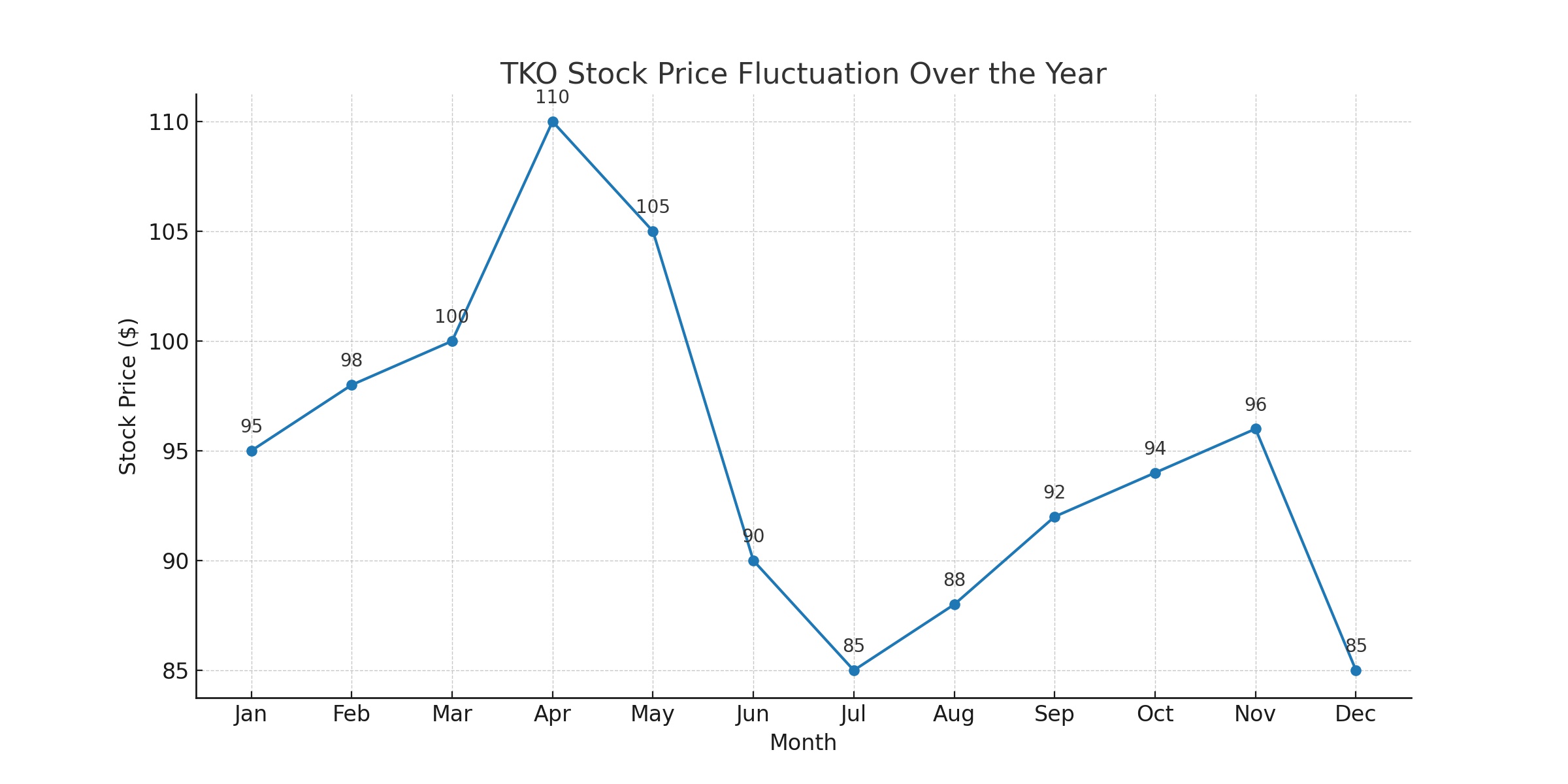

Despite a surprising 22% dip in stock price post-merger, TKO presents an attractive investment opportunity, underscored by its robust fundamentals and promising growth trajectory. This variance between market perception and company performance highlights the potential for value investment, especially considering TKO's strategic positioning and future prospects in a volatile market.

Institutional Confidence and Insider Transactions

The commitment of institutional investors and the strategic moves by insiders, as reflected in recent SEC filings and transactions, signal a strong vote of confidence in TKO's strategic direction and long-term value proposition. Interested stakeholders can delve deeper into insider transactions and stock performance insights by visiting specialized financial platforms, such as Trading News, for real-time data and analysis.

Strategic Outlook: Leveraging Synergies for Future Growth

Looking forward, TKO is set to capitalize on the synergistic potential between UFC and WWE, further expanding its global reach and deepening its market penetration. The company is strategically positioned to harness the burgeoning trend of online betting, alongside navigating the evolving entertainment landscape and market expectations.

Financial Snapshot: A Closer Look at TKO's Market Performance

TKO's current stock price of $85.57, with a slight fluctuation of -0.28% from the previous close, reflects the dynamic nature of the market. Despite the 52-week range showcasing a high of $118.04 and a low of $72.33, TKO maintains a steady average volume, indicating active investor interest and market participation. The anticipated earnings date and projections for the current and next fiscal year further underscore TKO's growth prospects and financial stability.

Conclusion: A Strategic Investment in the Entertainment and Sports Sector

TKO Group Holdings stands at the forefront of the entertainment and sports industry, offering a compelling investment opportunity through its diversified portfolio, strategic global expansion, and solid financial performance. As the company gears up for its upcoming earnings report, both investors and analysts will be keen to monitor TKO's progress, evaluating its capacity to sustain growth and profitability in a competitive landscape.

That's TradingNEWS

Read More

-

MAGS ETF Price Near $69 High: Mag 7 EPS Surge And AI Cash Flows Drive The $67.55 ETF

29.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $10.69 and XRPR at $15.15 Lead $1B Inflow Wave While Bitcoin ETFs Bleed $782M

29.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Jumps Above $4.60 as Storage Flips to Deficit and LNG Exports Hit Records

29.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Slips Toward 156 As BoJ Hawkish Turn Collides With Fed Cut Outlook

29.12.2025 · TradingNEWS ArchiveForex